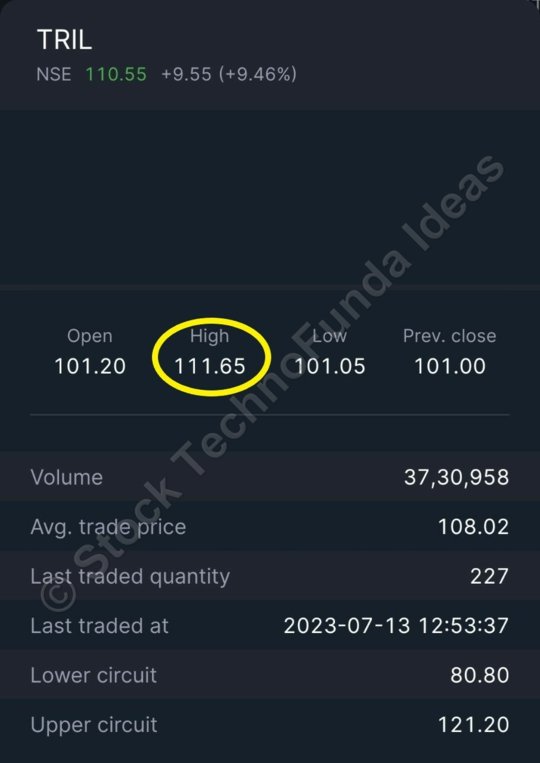

Transformers & Rectifiers (India) Ltd (64 to 111.65)

#TRIL

Recommended on: 14-May-2023

Recommended Price: 64

Today’s High: 111.65

Return Till Date: 74.45%

Date: 13-July-2023

Grab Highly Convincing Stocks Ideas for Free at: https://ttttt.me/StockTechnoFundaIdea

Join our Email News Letter at: https://joinfree.stocktechnofundaideas.com/

Contact Us on Email: info@stocktechnofundaideas.com

Contact Us on WhatsApp: https://api.whatsapp.com/send?phone=917778018979

History of TRIL:

In 1994, Triveni Electric Company Ltd was incorporated, which later changed its name to Transformers and Rectifiers (India) Ltd (TRIL) in 1995.

TRIL is a leading transformer manufacturer in India, with a wide range of transformers up to 1200 kV class.

TRIL’s Product Range:

The company’s product range includes power and distribution transformers, furnace transformers, rectifier transformers, and specialized transformers.

TRIL has strong in-house design and technical expertise, combined with technical collaboration/JV relationship for 765 kV transformers and reactors.

TRIL’s Manufacturing Facilities:

TRIL has two manufacturing facilities located at Changodar and Odhav in Ahmedabad.

In 2006, the company increased the production capacity of the plant at Changodar from 4000 MVA per annum to its present capacity of 6000 MVA per annum.

To facilitate this expansion, TRIL has initiated several expansion and de-bottlenecking procedures, including installation of new winding machines, separate oven for coil drying, segregation of dispatch area along with 100 MT capacity EOT crane, and employing additional manpower.

Diversified customer base

TRIL has a diversified customer base in India, coupled with an international presence in over 20 countries. Total 50% revenue comes from utilities (like state electricity boards, PGCIL, Railways), 44% comes from industrials that includes renewables and 6% exports including third party exports – utilities & power. The company is aggressively targeting export markets like Middle East, Russia, Africa, and the US for enhancing export segment revenues. Export orders generally have the best gross margin profile vis-à-vis domestic orders.

TRIL’s Future Plans:

TRIL plans to expand its capacity in FY24E to upscale its capacity to meet the growing demand for inverter duty transformers for solar plants and transformers required for electrolysis for producing hydrogen and ammonia. The company has a robust outlook coupled with an all-time high order backlog, which will allow TRIL to post a robust performance going ahead.