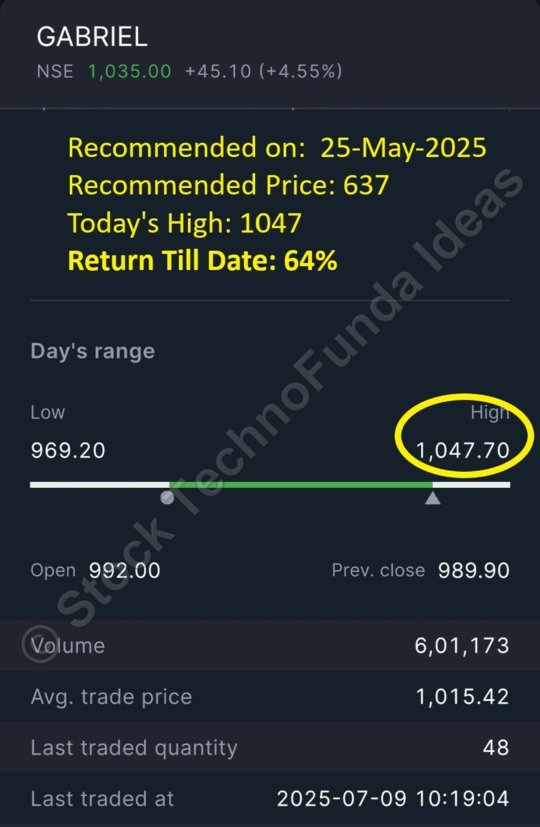

Gabriel India Ltd (637 to 1047)

#GABRIEL

Recommended on: 25-May-2025

Recommended Price: 637

Today’s High: 1047

Return Till Date: 64%

Date: 09-July-2025

Grab Highly Convincing Stocks Ideas for Free at: https://joinfree.stocktechnofundaideas.com/

Gabriel India Limited: A Leading Manufacturer of Ride Control Products in the Automotive Industry

Gabriel India Limited, a flagship company of the Anand group, is a renowned manufacturer of ride control products catering to all segments in the automotive industry. With seven manufacturing plants across India, Gabriel India has established a strong presence since its inception in 1961. The company specializes in producing shock absorbers, McPherson struts, front forks, and engine bearings.

Key Highlights:

Diversified Product Portfolio: Gabriel India offers a comprehensive range of ride control products, including shock absorbers, McPherson struts, front forks, and engine bearings, meeting the needs of various automotive segments.

Technological Collaborations: The company receives technological support from industry leaders such as Gabriel Ride Control Products (USA), SOQI/Yamaha Motor (Japan), Kayaba (Japan), APA-Kayaba (Spain), Arvin Suspension System Italia (Italy), and Federal Mogul Corporation (USA).

Strong Manufacturing Capabilities: Gabriel India operates manufacturing plants in Mulund, Nasik, Pune, Dewas, Hosur, Gurgaon, and Parwanoo, equipped with advanced technologies and ensuring high-quality production.

Focus on Electric Vehicle (EV) Space: With a dominant market share in the EV suspension market, Gabriel India serves marquee clients like Ola Electric, Hero Electric, Ather, Ampere, and Mahindra Electric. The company aims to develop EV-proof products and maintain its leadership position in this rapidly growing segment.

Market Performance and Future Outlook:

Strategic Growth Initiatives: Gabriel India aims to outperform the domestic automobile industry by increasing its penetration in the two-wheeler and PV segments. The company plans to maintain its market share in the electric two-wheeler segment and expand in the electric PV segment.

Technological Innovations: Gabriel India focuses on developing newer technologies such as semi-predictive suspensions for luxury cars. The company’s commitment to research and development ensures continuous technological advancements.

Financial Performance and Investment Theme:

Strong Brand Positioning: Gabriel India has established itself as a market leader in suspension components, boasting a strong brand recall. The company is well-positioned to benefit from the government’s push for EV adoption with its range of products for electric two-wheelers.

Investment Opportunity:

Based on Gabriel India’s robust strategies, technological prowess, and strong market position, we recommend a “Buy” rating on the stock. The company’s continuous efforts in expanding its market shares across segments make it an attractive investment option for medium to long-term investors.