To be a successful investor, you know that the road to financial success is paved with patience, perseverance, and unwavering commitment. It’s a journey that requires you to weather a multitude of challenges, from the moment you make your first investment to the moment you reach your ultimate goal. But fear not, for with the right mindset and approach, you can overcome any obstacle that comes your way. The key to achieving investment greatness lies in your ability to maintain consistency in your investment process and decision-making, even in the face of adversity. So, let’s take a closer look at some of the factors that could potentially derail your investment portfolio, and how you can proactively tackle them head-on.

1. Lack of Diversification and Over-diversification

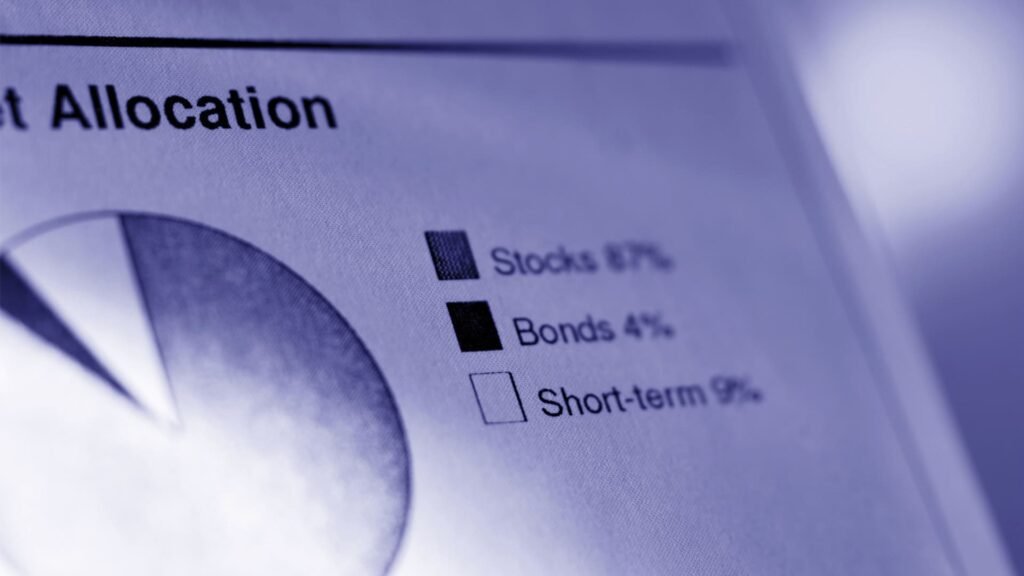

Lack of diversification and over-diversification are two sides of the same coin. While a lack of diversification can expose you to higher risk, over-diversification can make a dent in your portfolio return. Therefore, it is important to strike a balance between the two. A concentrated portfolio has the potential to generate higher returns, but the losses could be higher too. On the other hand, over-diversification in the portfolio allows non-performing investment options to remain in the portfolio. Therefore, it is important to avoid over-diversification and monitor the progress of the portfolio regularly to weed out non-performers from the portfolio.

2. Too Much Aggression in Portfolio Selection

Investing in aggressive stocks (mid-cap and small-cap) can result in much higher volatility in the portfolio. While it is true that aggressive stocks (mid-cap and small-cap) have the potential to deliver higher returns during certain market phases, there is no guarantee that it will happen. In fact, if the timing is not right, the volatility can be detrimental to your investment process. Therefore, it is important to strike a balance between aggressive and conservative investments.

3. Relying on Short-term Performance

Relying on short-term performance for stock selection can either make your portfolio very aggressive or very conservative based on what’s working out at that point of time. While higher allocation to short-term performance in a rising market can take you beyond your risk-taking capacity, a conservative portfolio can bring your real rate of return down. The right way to build a portfolio is to follow asset allocation and invest in stocks that have long-term consistent performance track records.

4. Thinking That Booking Loss Is a Bad Thing

If it is proved that there are non-performing stocks in the portfolio after giving them sufficient time to perform, don’t hesitate to make changes. Remember, booking losses is not a bad thing as long as it allows you to reinvest in better-performing stock ideas. Therefore, it is important to monitor your portfolio regularly and make changes when necessary.

5. Disregarding Your Time Commitment

Remaining committed to your time horizon can help you manage losses. Over time, an equity portfolio can deliver a positive real rate of return. Therefore, once a time horizon is decided, stay committed to it to benefit from the true potential of equities and enhance the chances of achieving your long-term goals.

6. Ignoring Opportunity Losses

Opportunity loss is the value or potential gains that you miss out by choosing a specific type of asset class, investment option or strategy. Therefore, it is important to monitor your portfolio regularly and be aware of opportunities that can help you improve your portfolio returns. Of course, making frequent changes can become counter-productive.

7. Strategy to Invest Conservatively to Avoid Losses Can Backfire

There can be a temptation to invest in less risky investments like bonds, FDs, small saving schemes to avoid losses in the portfolio. However, ignoring the risk of inflation and staying away from equity investment can result in a heavy loss in terms of negative real return. Therefore, including equity and equity-related funds should be a priority for long-term investments.

In conclusion, investing in the stock market can be a challenging journey, but with the right mindset and approach, you can achieve your investment goals. It is important to avoid the factors that can derail your portfolio, such as lack of diversification, too much aggression in portfolio selection, relying on short-term performance, disregarding your time commitment, ignoring opportunity losses, and investing conservatively to avoid losses. By following a disciplined investment process, staying committed to your time horizon, and monitoring your portfolio regularly, you can make informed decisions and improve your chances of achieving long-term success. Remember, investing is a marathon, not a sprint, and with patience, perseverance, and commitment, you can build a strong and resilient portfolio that can weather any storm.